In this course the possibilities of introducing the basic facts of mathematics of finance at school level by using e-stat are shown. The basic facts ground on the discrete option pricing theory in the one-period binomial-tree-model in complete markets. Within this introduction the basic elements of mathematical stochastics are brought forward. Options and their trading are explained. Elementary facts of financial markets which are necessary to understand how to trade with options are also explained.

The difference between speculation and hedging is also shown. The question whether trading assets is "only a game of chance" where nothing can be predicted about gain or loss in the future (speculation) or whether there are possibilities to influence coming gain/loss (hedging) is answered.

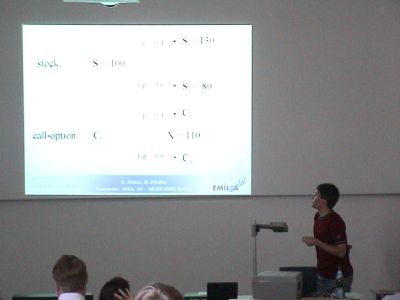

The problem of hedging is studied in more detail by introducing the term of "arbitrage". A simple explanation of this could be "How to earn money without investing a zero amount". Additionally it is discussed how to prevent this possibility by choosing the correct price of the option. The formula worked out in this section to calculate that price is the product of hedge-ratio and discounted difference of the stock-price. There are concrete examples for a better understanding and illustration. Additionally the interactive abilities using e-stat are shown by some Java-applets which enable the pupils to test the theory and to calculate a correct price of an option themselves.

Furthermore the so-called leverage-effect is studied which is caused by trading with options. It is shown that more stocks are moved with pure trading of options than with pure trading of stocks, having equal inputs.

Another subject is the combination of option trades. Typical constellations, such as spreads, straddles, strangles, strips and straps are presented. Again the interactions using e-stat are shown by Java-applets.

Bibliography:

[1] M. Avellaneda and P. Laurence: Quantitative Modeling of Derivative Securities. From Theory to Practice, Chapman & Hall, 2000

[2] N.H. Bingham and R. Kiesel: Risk-Neutral Valuation. Pricing and Hedging of Financial Derivatives, Springer 1998

[3] R. J. Elliot and P.E. Kopp: Mathematics of Finance Markets, Springer, 1999

[4] A. Klotz and J. Philipp: Die Welt der Optionsscheine, FinanzBuch Verlag München, 2000

[5] D. Pfeifer: Zur Mathematik derivativer Finanzinstrumente: Anregungen für den Stochastik-Unterricht, Stochastik in der Schule 20 (2000), p. 25 - 37

[6] S.R. Pliska: Introduction to Mathematical Finance, Blackwell, 1997

[7] E. Z. Prisman: Pricing Derivative Securities, Academic Press, 2000

[8] K. Sandmann: Einführung in die Stochastik der Finanzmathematik, Springer, 1999

Keywords:

Stochastic education at school, options, option pricing theory, discrete mathematics of finance, financial markets, binomial-tree-model, leverage-effect, Java-applets, combination of options, arbitrage